one of the entrepreneurs on ABC's Shark Tank second show of the season. The second show featured a much more active engagement of the sharks who invest their own money into the businesses then in the season premier that appeared last week. And as you might expect with sharks there was some cooperation and also some in-fighting for the ideas they thought were worth their hard earned money.

one of the entrepreneurs on ABC's Shark Tank second show of the season. The second show featured a much more active engagement of the sharks who invest their own money into the businesses then in the season premier that appeared last week. And as you might expect with sharks there was some cooperation and also some in-fighting for the ideas they thought were worth their hard earned money.If you read my previous post you know that I take a pretty critical look at how these entrepreneurs and inventors approach pitching their products to the sharks and let you know if they made a good deal or a bad deal or if they really needed to rethink their overall strategy. What I am finding with the sharks is they are starting look and sound a little like vulture capitalists who are in it to see how much they can steal great deals from these entrepreneurs. However you can't go on this show and expect anything less.

CROOKED JAW

First up was Craig French who developed a clothing line called Crooked Jaw. He was asking for $200,000 for 20% stake in his company. While the company was an inspiration from an accident Craig suffered playing lacrosse and now he believes his brand is ready to take off and he was hoping and putting a lot of faith that Damond John who has built a very successful clothing line FUBU will buy in.

CROOKED JAW

First up was Craig French who developed a clothing line called Crooked Jaw. He was asking for $200,000 for 20% stake in his company. While the company was an inspiration from an accident Craig suffered playing lacrosse and now he believes his brand is ready to take off and he was hoping and putting a lot of faith that Damond John who has built a very successful clothing line FUBU will buy in.

Damond who obviously knows the business not only was asking the toughest questions of Craig, but he was also the guide for the rest of the Shark's who kept deferring to his expertise in the field. While Craig tried to sell the Sharks on the future potential of the brand there were many warning signs that signaled danger to the Sharks as well as Damond, who in the end gave it a negative potential.

It never ceases to amaze me how people believe that their inspiration will make someone actually want to invest. The reality was the company had only made $5,000 to date and had no national recognition, they also had no spokesperson and did absolutely terrible at there one and only Tradeshow taking zero orders. Damond hammered the nail in the coffin by saying that there are over 10,000 companies just like Craigs and right now he has nothing special to differentiate himself. The key here is this a belief in an idea by the owners of the company carries very little weight with investors. Get testimonials from influential people that can positively influence buyers in your genre or build a following, but don't come to the table empty handed like Crooked Jaw did.

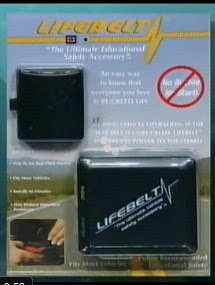

LIFEBELT

Robert D. Allison III inventor of LifeBelt which is a safety device that prevents a car from starting unless the drivers seat belt is

buckled. He was asking for $500,000 for 10% of the business. He owns the patent on the technology and had test marketed selling it to three major automotive manufactures of which he indicated one was very interested. He presented a compelling story about how a family member was killed because she was not wearing her seatbelt and that was when he thought about a solution. Mr. Allison felt that if he could get his product known that he could save millions and millions of lives and protect children when they first start driving by making sure they buckle up. The safety statistics he noted regarding accidents and safety of seatbelts were helpful and he had some significant interest from Sharks Kevin O'leary and Robert Herjavec.

buckled. He was asking for $500,000 for 10% of the business. He owns the patent on the technology and had test marketed selling it to three major automotive manufactures of which he indicated one was very interested. He presented a compelling story about how a family member was killed because she was not wearing her seatbelt and that was when he thought about a solution. Mr. Allison felt that if he could get his product known that he could save millions and millions of lives and protect children when they first start driving by making sure they buckle up. The safety statistics he noted regarding accidents and safety of seatbelts were helpful and he had some significant interest from Sharks Kevin O'leary and Robert Herjavec.Kevin offered him $500,000 for the patent and that he never wanted to speak to him again. Robert offered him One Million Dollars for the Patent and he said he could call him once. Most inventors I have met would probably sell their invention for One Million Dollars in a heartbeat, but Mr. Allison did not seem to feel the same. He believed his idea was worth quite a bit more considering his request for investment would make the company worth $5 million.

So did he make a mistake?

And the answer is a resounding maybe, or maybe not. OK, why am I being so wishy-washy on this one, how can anyone turn down big money that is cash now in your pocket. Well it depends on what Mr. Allison reasons were for saying no. He may have already received legitimate interest from the major automotive manufacturers and let's assume that the product which retails for over $220 can be maded for less than $50 (which is almost a certainty especially in volume). Even if Mr. Allison sold the product to GM at the wholesale price of $100 he would still be making a healthy profit and if GM decided to just equip this in 20,000 vehicles with GM recently selling about 180,000 vehicles per month this would not be difficult to attain even on an annual basis. And if that is the case then yes, he made a smart decision.

However if his plan was to run the business and try to grow organically, unless he has a lot of resources he may have made a bad choice by passing it up. I think that both the Sharks and Mr. Allison lost in this deal. I think the Sharks were too greedy if they would have structured a licensing deal or even a small percentage for Mr. Allison, I think he might have had to think twice. And Mr. Allison's lack of charisma and some negative vibe he gave off turned the Sharks off dramatically that they did not even want to partner with him. I think the Sharks insulted him and that turned him off to any amount of money offered him. He kept saying he wanted to make sure his device saved lives and got to as many people as possible.

Well I submitted a form on Mr. Allison website and offered to start selling his product right away through the 150+ automotive accessory web sites I manage and I only received an automated e-mail response and nothing else for the last 4 days. Hopefully he is really busy with GM, Ford, Chrysler, Honda, Toyota or another manufacture moving the product. Otherwise like many other dreams, his product will get knocked off by someone else who can make it different enough to avoid patent infringement and he will wish he took that million dollar deal. Oh yeah and Robert call me or e-mail me.

A PERFECT PEAR

Susan Knapp is a gourmet cook who created a line of products that feature pears from jellies to

marinades needed money to handle her increased demand. She was asking for $500,000 for 15% of her company. She had tried the traditional method for getting money through banks and like many small businesses could not get a loan. Susan wanted the Sharks to take a bite, so she brought samples of her jams and jellies on pastries to try. Everyone seemed to like her story. Her problem was her profit margins were tight about 2.6% on $700,000 in annual sales.

marinades needed money to handle her increased demand. She was asking for $500,000 for 15% of her company. She had tried the traditional method for getting money through banks and like many small businesses could not get a loan. Susan wanted the Sharks to take a bite, so she brought samples of her jams and jellies on pastries to try. Everyone seemed to like her story. Her problem was her profit margins were tight about 2.6% on $700,000 in annual sales.The Sharks got an appetite when she told them that she had $100,000 in orders waiting to be filled. Kevin O'Leary offered the 500k for 70%, then Kevin Harrington and Robert Herjavec decided to combine forces and offer 500,000 for 50% of the business. Damon also came in with a bid of the $500,000 for 51% of the company. So now it was a matter of deciding between 1 partner 2 partners or walking away. She first countered to see if she could keep control and offered 49%. None of the sharks liked the idea of giving up that much money without some level of control. She accepted the deal from Kevin and Robert and Damon was regretting not matching the deal.

Susan had what many new businesses featured on the Shark Tank show lacked. Solid revenue a customer base of 650 which showed market acceptance, demand she could not meet and a growth strategy with increased profitability to 10% and 1.2 million in 2010. Plus she had a clear vision and confidence that her company would be a $20 million company in the future. For her the risk of taking on two new partners was both exciting and a little fearful. Could she have received a better deal, probably not because the profitability was not there. Plus I am sure the extra television exposure will help her product move better in the future. I think she got a pretty good deal and I think we will see her brand sold nationwide very soon.

ATTACH NOTED

The next contestant was Mary Ellen Simonson inventor of a new product Attach-Noted. This product was supposed to solve the problem of unorganized sticky notes all over your computer. It basically was a mini bulletin board that attached along the height of a small laptop. Ms. Simonson was asking for $100,000 for 20% of her company to launch the product. The business had no sales to date and the key feature of the product was that it could fold into the laptop when the cover is closed. When asked about the opportunity for the product she referenced statistics for how many laptops and computers are sold every year, but she had no market research to back up the claim that this problem is a real problem for people and how significant that problem might be. She then told them that the selling price was going to be $9.95 for this very small product and at that pint all of the Sharks passed on investing.

The reality is the product might be a viable product but Ms. Simonson did so many things wrong in developing a concept for it and creating a value proposition that no one got it. Her first problem is she was in love with her idea and never thought of getting input in helping her shape the use of the product. She never created the overall value because she defined the product based on a very narrow view of how the product was able to help her with her sticky note problem and this was her downfall. No one bought that this was the true benefit of the product, they could not relate with it's benefit.

As I sit here today I can see many other potential uses for the product as a true bulletin board concept that can do more than just hold sticky-notes. If she had done some focus group testing even with friends from different walks of life and did not have a pre-conceived notion of what the product was to be used for she may have come up with many other potential solutions. Just off hand I can think of several others like a picture frame, a plastic sleeve to hold small sheets of paper that are not sticky notes, maybe even a pen holder. If she could have envisioned her product to be more flexible and then put together some real market research data that could show demand for such a product I think she would have had a very different outcome with the Sharks. Whenever you think that you are like the rest of the world and your problems are the same as everyone else with no market research you our bound to fail.

CLASSROOM JAMS

Mark Furiguy a Chicago high school teacher turned a new way of teaching classic English literature into business opportunity.

He was looking for $250,000 for 10% stake in his new record label and publishing house called Classroom Jams. He used popular music to help kids learn otherwise difficult school subjects into language they could relate to with modern words and sound. He envisioned his products being sold to classrooms throughout the country. For the first time every Shark wanted in, so they teamed up to offer him the $250,000 for 100% of record label and provide him 5% Royalty on profits. He wavered and needed time to decide and was noticeably overwhelmed with the offer. To add to the confusion Robert actually competed against the group and offered 250,000 for 100% stake in the record label and the ability to earn back 49% of the company based on profits. Mark countered with 8% royalty and wanting to be an equal partner with the other five but liked the idea of five partners instead of one. The agreed in the end to provide him ability to earn 20% back into the company based on his royalties from sales being put back into the company to get until he could get his equal share.

He was looking for $250,000 for 10% stake in his new record label and publishing house called Classroom Jams. He used popular music to help kids learn otherwise difficult school subjects into language they could relate to with modern words and sound. He envisioned his products being sold to classrooms throughout the country. For the first time every Shark wanted in, so they teamed up to offer him the $250,000 for 100% of record label and provide him 5% Royalty on profits. He wavered and needed time to decide and was noticeably overwhelmed with the offer. To add to the confusion Robert actually competed against the group and offered 250,000 for 100% stake in the record label and the ability to earn back 49% of the company based on profits. Mark countered with 8% royalty and wanting to be an equal partner with the other five but liked the idea of five partners instead of one. The agreed in the end to provide him ability to earn 20% back into the company based on his royalties from sales being put back into the company to get until he could get his equal share.I think I know why the Sharks really liked the products. First he was selling to an industry that is finite but has budget for these type of learning enrichment programs and is virtually recession proof. Second, the products did to classical literature what Baby Einstein did to classical music and that was find a better way to teach young minds that made it easier for them to understand. The single segment of the toy industry that has grown the fastest is the educational toy industry, which shows that his products could have demand outside of the educational system as well. Third he picked the most popular works that were sold worldwide and had it copyrighted which is Shakespeare to start. His packaging and professionalism was very polished for a school teacher. It was still a big chunk of his company, but since he had not sold any product as of yet this is probably the best deal he could get. It would be very similar to the way a record label would have approached him.

I think he should have spoken to a few record labels first just to get a feel if this deal was going to be good or not. I also think if he had the time to run the business at about $500 a set he could would only have had to sell 500 sets to get the same money. However if you do not know how to execute this type of strategy it is better to team up with those who can. I just hope he knows what it means to have 5 partners.

No comments:

Post a Comment